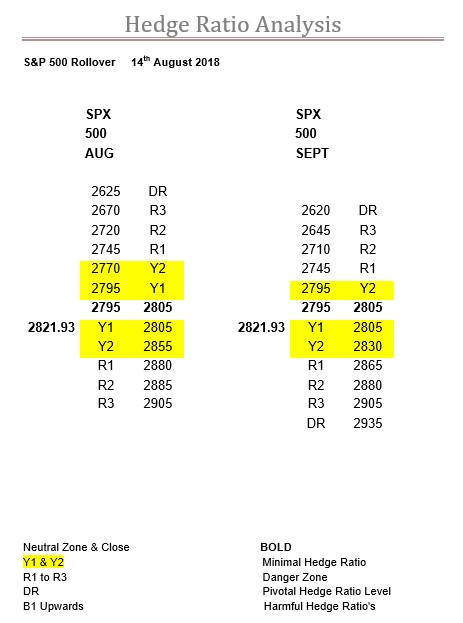

SPX Aug to Sept Ratio Rollover Table 14th Aug 2018

It has been a very controlled expiry so far for the SPX, all that remains to be seen is if it can maintain this for the next few days, or at least until tomorrow.

From the very start of this expiry on the 23rd July this index set its stall out with the low of 2795.14 and the high of 2808.62, or to be more precise a zone bandwidth test.

It then went on to test R1, which was then at 2850, with the high of 2848.03, that same week before settling down and returning to its zone by the start of the second week.

Of course, for them to have a perfect expiry we would have needed to see a test of 2720, but at the end of the day it couldn’t break down and below its zone.

This was in large part due to the DJX, which was at that point in time battering on their zones upper boundary, 25500, which made it hard for this index to go in the opposite direction.

However, the SPX did return the favour, as when the Dow eventually got above its upper zone boundary, here they were running into R1 again, which by this time had slipped to 2860/2865, and this time it was the DJX’s turn to fight against the tide.

Currently, the SPX is in a good spot, no real pressure, as with their Y1 ratio bandwidth now stretching up to 2855 anywhere here or hereabouts would not be too bad.

In fact, the zone could easily flip to 2820-2830, or higher, so that gives it plenty of tolerance for a successful expiry.

The only issue may be that under these circumstances it can sometimes get a bit blasé or overconfident, so can find itself getting ambushed if one of the others, probably the DJX, has an agenda.

Range: 2805 to 2880

Activity: Average

Type: Bearish

We always like to think that when the big expiries come around the SPX should stand up and take over, making sure everyone knows its time for the big boys to play.

Weirdly, however, this never seems to happen, and despite the enormous increase in activity making it easily the biggest player in town, it can still get bullied and pushed around.

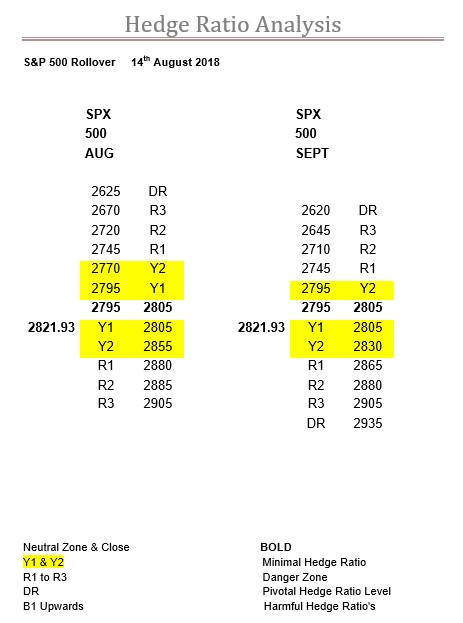

There is still three days to go, and we are rolling over into a five-week expiry, which means the first “extra” week can be a slow starter, so a lot can and probably will change, but it is nice to see so much Y ratio present in a triple witching expiry.

Nevertheless, there are a couple of pointers we can ascertain this early, and the main one is that the mighty Sept would not get in the way should August’s zone change to 2820-2830.

However, anything above that may cause issues.

Secondly, that the R ratios start at 2865 above the zone and then build all the way to R3 quite quickly, or within 40-points at least.

Normally, we would expect the ratios to build (come in towards the zone) either side at this stage, so if anything, this should narrow.

Interestingly, this is not the case below the zone, and you have to get down to 2645 before one encounters R3, which is almost 200-points from where the market is now, to put (no pun intended) it into perspective.

Therefore, it is worth mentioning the Delta Ratio we calculate is already standing at 67.9%, so while this is not at an extreme it is indicative of there already being a significant put bias, which considering how the ratio cards have fallen, is contradictory.

No matter how the ratios develop, as things stand, there is still 120-points between the R1 ratios, so a more than a decent enough trading range, and on top of this it would be a very rare triple that was contained inside just R1, so should be fun.

Range: 2805 to 2855

Activity: Average

Type: Neutral