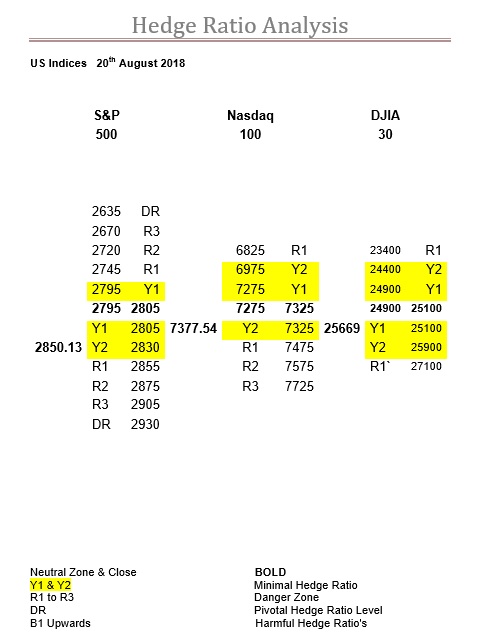

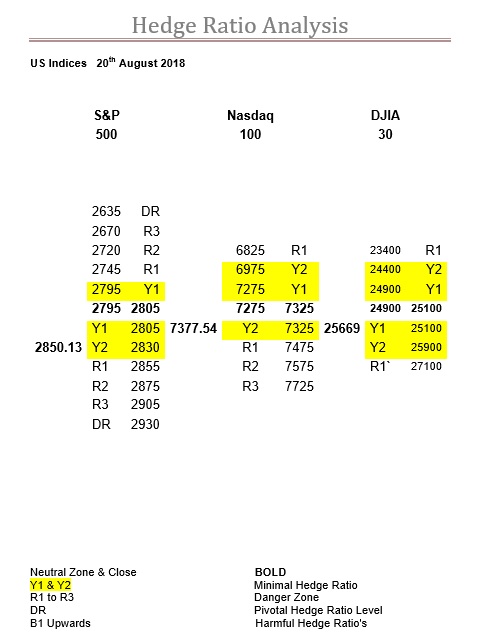

SPX , NDX & DJX Ratio Table 20th August 2018

It is nice to go back to one of the old school expiries for a change and not just in the SPX.

However, here, this meant last rollover Wednesday hitting their zone, leaving the Thursday and Friday to being what we used to call the grey area, where neither but both expiries are in charge.

Anyway, the upshot is, with those two grey days, we get an exciting start to September.

As just above this market, at 2855, lies R1.

At, or towards, the end of this expiry we would not expect this level of ratio to be more than say a speedbump, but right at the start it can prove to be far more potent, so it should prove an interesting test for this index, very probably when it is not expecting it at all.

Finally, we should mention that although activity only come in as average please don’t forget this is a triple so average is in fact very good.

Range: 2805 to 2855 or 2855 to 2875

Activity Average

Type: On balance just fractionally bearish

The NDX in Sept could be the deciding factor, and it has been a very long time since we have seen this potential here just by normal everyday activity, albeit this is a triple of course.

Basically, all the ratio movement has been above the zone, and it is of such that it should impact immediately.

The main point is that for a long time the NDX has struggled with Y2, but this hasn’t been that much of an issue as there has been plenty of Y1 to play around in.

However, this expiry kicks off with no Y1 now above the zone, so will this index react as it has been doing when it encounters Y2, or will it front up and treat Y2 as if it is the new Y1?

Either way, we should soon see, but just looking at the table above it is plain to see the depth of ratio now above the zone, and we can’t remember when we last saw R3 without the appearance of the big players.

We should also add that a lot of these ratios above the zone are at the high end of that levels range, so it wouldn’t take much to tip them over the threshold and up another level.

Interestingly our old friend 7475 looks like it is going to play a big role in Sept as well, so this is fast becoming a very significant level, far more than just R1 suggests.

Range: 7325 to 7475

Activity: Good

Type: Neutral

Our suspicion is the real problem for the Sept expiry will be the DJX.

Last Wednesday the DJX got as low as 24965, which was as close to dead centre of that expiries zone as you are likely to get.

The point being, is that throughout the last expiry we took great pains to point out how fixated this index was with the top boundary of their zone, 25500, so when the pressure was off in those last two grey area days we were not surprised at all to see it make a beeline straight back there.

The $100 question is now that we are in September is this still the agenda?

To further complicate matters we have reverted to the more standard form of zone, or one that is just a mere 200-points wide, which is now a very long way below where this market currently is.

So, they have already broken free of their zone here, actually they start above it so no actual need to break through anything, and they now face Y2 just ahead.

Will Y2 prove to be a problem, we just don’t know until it is tested, for the simple reason that do they feel emboldened by eventually breeching 25500, so is that job done to them, or now game on?

Range: 25100 to 25900

Activity: Average

Type: On balance fractionally bullish