Nb. Our comment from the 08/03/21

The zone moved the very next day after we published last, so Thursday 29th.

In yet another apology from us, as we are seriously so underwhelmed by this, we hope it does not distract from these comments.

Of course, these days this is getting quite commonplace, but for far too long than we would like to remember, a zone move in the SPX was a really exciting event.

Nowadays, it is just as if by default, virtually natural geological erosion, albeit of the ratio variety other than natural features, rather than synthetic in nature.

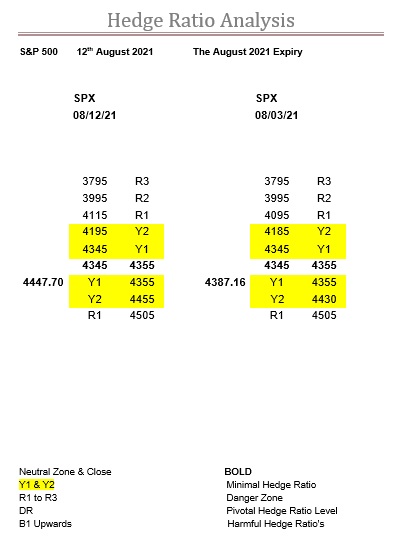

Which essentially means the Y1 ratio bandwidth remains static at 245-points, as does the overall Y ratio bandwidth, at 410-points.

Remaining ridiculously wide, and therefore still very dangerous.

But, in the meantime, what we said last time is evidently what is still happening, as it knocked on the Y2 ratio door at 4415 last Wednesday, with the intraday high of 4415.47.

As you can see from the table above, Y2 is now 4430, and the intraday and, so far at least, expiry high, was 4429.97, the very next day. As we said, “knock knock knocking on the retreating Y2 ratio door”.

Activity has also seemingly dried up, but then again, as we are in the third week of a five-week expiry, then this is not really unusual.

As the SPX goes through the mid-expiry motions, it creeps higher leaving a vast void of practically no support beneath it.

So, on the surface it all looks good, even peaceful and serene, with rising ratios below the zone, which is in itself rising, as well as retreating ratios above it but, make no mistake, this is not a risk-free market, although most evidently think it is.

For us this risk is actually quantifiable, as the corresponding Y2 level is currently at 4185, which is 202-points away (4.6%), which should at the very least give you something to put into your models.

Range: 4355 to 4430

Activity: Poor

Type: On balance bullish

Nb. Our comment for 08/12/21

Bang on the money, or probably more appropriately, still banging on that Y2 ratio door.

As one can see from the above table, that this particular door is now standing at 4455.

We haven’t calculated the ratios this week until today, but last Friday Y2 was 4430, so the market essentially forced the door ajar and got a foot on the other side.

The start of this week was effectively the market waiting for the ratios to catch up.

But now they have forced the changes, then the dominoes keep falling.

OK, the ratios below the zone have hardly shifted, but they are certainly building up to it.

In the meantime, the zone will move up again, to 4395-4405, and we suspect the only limiting factor to further moves is that it is the rollover and expiry next week, so time.

Of course, Y2 is very likely to continue to retreat, and we suspect R1 will start doing so before long as well.

So really, the only main concern is the fragility of it all, as the Y1 ratio bandwidth increases to 260-points, whereas the overall Y ratio bandwidth narrows to 390-points, both still ridiculously wide.

It is the most amazing market we have come across, as it continually powers to new highs, but at the same time, overall, the level of ratio is abysmal as are the daily levels.

This means that this bull run and resultant new all-time-highs have been achieved without very many bulls at all.

The saving grace has really been that there have actually been fewer bears than the miserly number of bulls out there, but, hey, whose to say that’s not wrong, it’s just that previously the numbers have just been far bigger but the split remains the same.

Range: 4355 to 4455

Activity: Poor

Type: Neutral